Consumers around the world feel more invested than ever in what makes people feel both well and prosperous, we learn in the NielsenIQ Global State of Health & Wellness 2025 survey report.

But there’s a trust deficit that must be healed in order for a health consumer to invest in services and products that feed health and well-being.

NIQ fielded the survey research online in January and February 2025 among nearly 19,000 adults living in 19 countries: Brazil, Canada, China, the Czech Republic, France, Germany, Hungary, India, Indonesia Italy, Mexico, Netherlands, Poland, South Africa, Spain, Turkiye, UAE, United Kingdom, and the U.S.

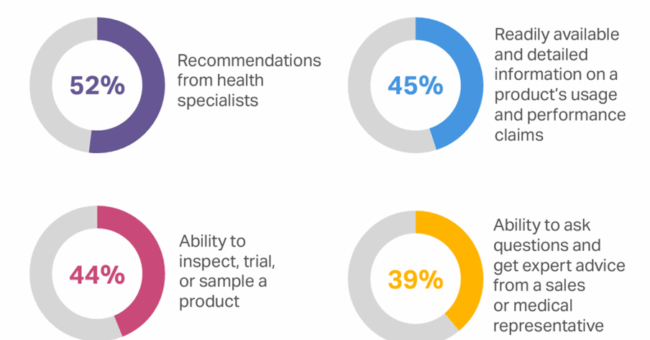

To breach that trust-gap, most people would welcome recommendations from health specialists. Furthermore, health-seeking consumers would value detailed information on a product’s use and performance claims, as well as the ability to trial or sample a product. Over-one-third of people would also like to gather expert advice from a company sales or medical representative.

That’s because consumers feel inundated with competing messages and perceived overclaims, NIQ found. Today’s health consumer is more aware and informed than ever, NIQ explains.

But there is a chasm between healthy aspirations and people’s actual behaviors.

Five factors get in the way of people making healthier life choices, listed here in the chart:

First, there’s the matter of cost, with most people saying expense is a barrier to choosing a healthy option.

Second, one-in-three people note it’s difficult to find healthy alternatives based on their geography.

Third, it’s a matter of time: some folks say they don’t have the time to make the healthy choice.

Fourth, one in four consumers do not feel motivated to choose healthy.

Finally, fifth, 25% of consumers do not trust that the product or service will be effective as claimed.

So clarity and transparency would be keys to re-building trust, engagement, trial, and finally adopting a health-promising product or service.

One of the key global consumer trends is peoples’ value and adoption of digital tools to improve health, lifestyles, and home environments.

One in five consumers globally would prioritize purchasing a water filter, a wearable tech (such as a smartwatch), an air purifier, or a low-fat cooking device (think: air fryer, steam cooker). We’ve seen these four devices/technologies growing on the supply side at the annual CES for the past several January’s (see this post here in Health Populi for more on these trends).

Health Populi’s Hot Points: Over one-half of consumers say they would spend over $ 100 a month on their wellness, NielsenIQ calculated.

If we annualize that number for U.S. consumers, that would add another $ 1,200 on top of their traditional medical costs, which already consume a significant line-item in families’ household budgets in close contact with housing (mortgage or rent), utilities, and food costs.

For context, health care costs in the U.S. hit nearly $ 15,000 per capita in 2023, according to CMS’s National Health Expenditures analysis.

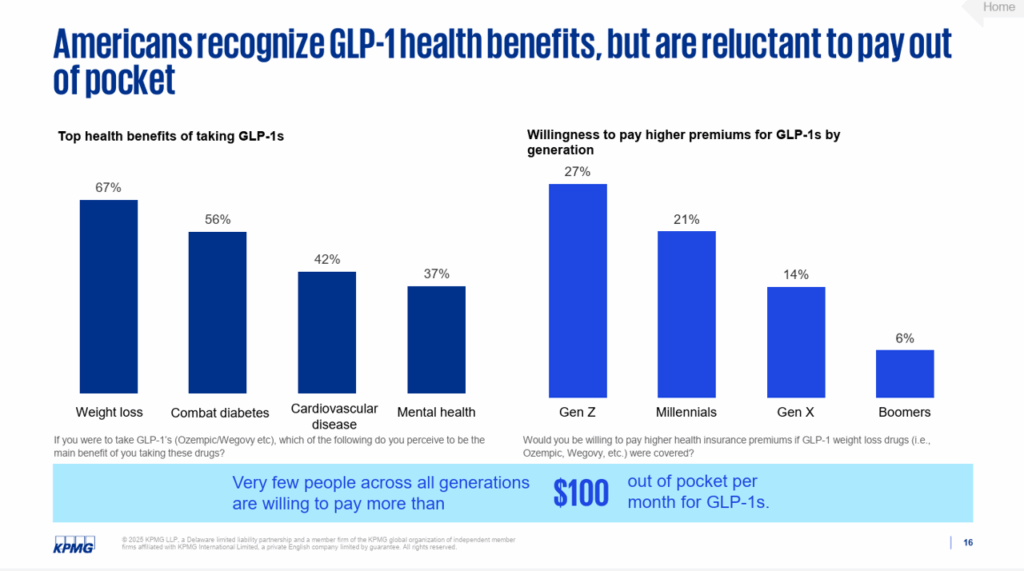

In the NIQ research, financial and mental health co-mingle and blend into physical and clinical health in the eyes of consumers, so this added spending is an investment health-oriented consumers would take to risk-manage their overall wellness beyond their physical health as measured in a traditional medical record or insurance claim. Consider health consumers who have opted into purchasing and consuming Anti-Obesity Medicines (AOMs, which NielsenIQ discusses in the report). For those patients-as-consumers whose health plans do not cover, say, Wegovy or Ozempic, the physical and the fiscal (payment) worlds can collide and force an internal debate for that health consumer on value-vs-values, demonstrated in the chart from KPMG’s health consumer research.

Core for organizations seeking to engage with this consumer in a direct-to-consumer relationship (that is, direct payment out-of-pocket) will be to attend to trust — in terms of both product/service claims and science-backed evidence along with respecting and protecting people’s personal health (and other) information in a secure and respectful way. Privacy-, security-, and trust-by-design are called-for in this growing age of peoples’ wellness expectations across all aspects of health and self-care.

The post Consumers Are Keen to Invest in Health and Well-Being – But Show Them the Evidence appeared first on HealthPopuli.com.